With the rapid development of global e-commerce, the security of online payments has become a focus of attention for merchants and consumers. As a payment service provider, it is our responsibility to ensure the security of every transaction. In order to help customers prevent fraud and improve the payment experience, MoneyCollect fully integrates 3D Secure technology to ensure the transaction security of merchants and consumers.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

What is 3D Secure?

3D Secure (Three-Domain Secure) is an online payment security protocol first launched by Visa, which aims to reduce the risk of online transaction fraud by adding additional authentication steps. The protocol has now been widely adopted by other payment networks, such as Mastercard's SecureCode and American Express's SafeKey. It is based on the collaboration of three domains: merchants, card issuers and payment networks, which work together to ensure the security of online payments.

3D Secure 2.0: The balance between user experience and security

Although traditional 3D Secure performs well in security, the user experience problems it brings have also troubled merchants and consumers. For this reason, 3D Secure 2.0 came into being to solve the contradiction between user experience and security. The new version of the protocol uses advanced technology to analyze the risk of each transaction, providing a seamless payment experience for low-risk transactions, while for high-risk transactions, additional verification steps such as SMS verification codes or biometrics are introduced.

MoneyCollect chose 3D Secure 2.0 as its core payment security solution to ensure that our customers enjoy industry-leading security without sacrificing user experience.

How does MoneyCollect use 3D Secure to protect merchants and customers?

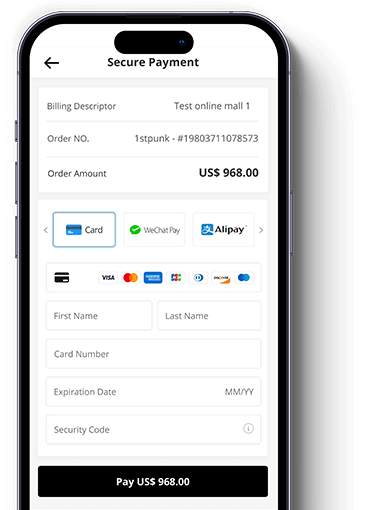

As a professional payment service provider, MoneyCollect is committed to providing secure and efficient payment solutions to merchants and customers around the world. With the integration of 3D Secure, our payment platform is able to perform intelligent risk assessment during the transaction process and trigger additional authentication steps when necessary. This not only reduces the risk of fraud, but also ensures that merchants can avoid financial losses caused by fraudulent transactions.

Intelligent Risk Assessment

MoneyCollect uses the risk assessment function of 3D Secure 2.0 to automatically assess the risk of each transaction based on factors such as transaction amount, geographic location, device information, etc. If the transaction is judged to be low risk, consumers can enjoy a smooth payment experience without additional authentication.

Recommended reading: "How to Open a Bank Account Online with No Deposit: A Step-by-Step Guide."

Multi-layered security

For high-risk transactions, 3D Secure provides additional verification by sending a verification code or requiring biometrics, ensuring that only authorized users can complete the transaction. MoneyCollect's platform seamlessly integrates these additional verification steps into the payment process, effectively protecting merchants from the threat of fraud.

Global support

Whether merchants are doing local business or cross-border transactions, MoneyCollect's 3D Secure feature can provide strong payment security. We support multi-currency and multi-language payment environments to ensure that merchants around the world can benefit from it.

Benefits of 3D Secure

For merchants, 3D Secure is not only a security tool, but also a key technology to improve customer trust and satisfaction. Its main benefits include:

Reduced chargeback risk

When merchants enable 3D Secure, the issuing bank assumes greater payment responsibility, which effectively reduces the risk of chargebacks encountered by merchants due to fraudulent transactions.

Enhanced customer trust

Providing a secure payment environment helps to improve customer trust in merchants and increase customer retention.

Global compatibility

3D Secure technology is accepted by most card issuers and payment networks around the world, allowing merchants to conduct international business with peace of mind.

Summary

In the current digital economy, payment security is of vital importance. Through close integration with 3D Secure technology, MoneyCollect provides powerful payment security protection for global merchants, helping them maintain their competitive advantage in an increasingly complex payment ecosystem. We will continue to be committed to providing customers with more secure and convenient payment solutions to ensure that every transaction can be completed in a secure environment.Choose MoneyCollect, choose a secure, convenient and global payment solution.