Since Apple Pay was launched in mainland China, it has quickly won the favor of many users with its convenience and security. Whether it is a quick swipe at a subway station or a quick checkout at a shopping mall, Apple Pay provides us with a more efficient payment experience. However, with the popularity of mobile payments, security issues have also received more and more attention. So, is Apple Pay really safe? Let's take a detailed look at the security mechanism behind it.

Key Features:

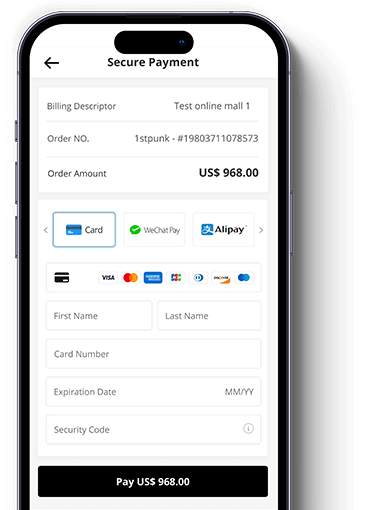

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

Multiple encryption technology: building a solid line of defense

The core security technology of Apple Pay is based on a highly complex multiple encryption system. When you bind a bank card to your device for the first time, all information will be converted into encrypted data instead of being stored directly on the device or Apple servers. The unique encryption key generated by the device ensures that every transaction is verified, preventing hackers from stealing users' sensitive information during transmission.

Case support: According to a report by International Data Corporation (IDC), more than 98% of all Apple Pay users have never encountered payment information leakage during use, proving the reliability of its technology.

Biometric technology: Strengthen user authentication

Apple Pay introduces biometric technologies such as Touch ID and Face ID to further enhance the security of the payment process. Compared with traditional password verification, biometric technology not only prevents the risk of password theft, but also ensures that only the device owner can complete the payment through unique personal biometrics.

For example, when you use Apple Pay to check out at a mall, the system will automatically request facial recognition or fingerprint verification to ensure that you are the one who authorized the transaction. This biometric verification greatly reduces the possibility of identity fraud.

Device Account Number: Security Protection of Virtual Card Number

Another key security measure of Apple Pay is the use of a virtual card number system. Every time you pay, Apple generates a unique device account number (Device Account Number) instead of directly using your credit or debit card number. This means that even if hackers can steal transaction data, they cannot obtain your real card number information, further improving account security.

Privacy protection: User data is absolutely confidential

Apple has always been known for its strict privacy protection policy, and Apple Pay is no exception. Apple does not store users' actual card information, nor does it use users' transaction data for advertising purposes. Transaction information is only transmitted between users, merchants and banks, and no third party, including Apple itself, can access this information. Such privacy protection measures provide users with additional peace of mind.

Can Apple Pay support buy now, pay later?

Once upon a time, Apple launched a buy now, pay later service called "Apple Pay Later", allowing users to pay for consumption in installments without interest. This service debuted in March 2023 and attracted the attention of many consumers. Users can repay up to $1,000 in four installments within six weeks, eliminating the pressure of interest.

However, with the changes in the market environment and the adjustment of the company's strategy, Apple announced the termination of the service in June 2024. This means that Apple Pay does not currently support the buy now, pay later service, but it is not ruled out that Apple may launch similar features again in the future to meet user needs.

I believe you may also be interested in this article: How to Get Free Shein Gift Cards? Everything About It

Recommended global payment gateway: MoneyCollect, making cross-border payments seamless

In the field of global payments, it is crucial to choose a safe, reliable and widely covered payment gateway. MoneyCollect is undoubtedly one of the recommended solutions, especially for companies with cross-border business needs.

Ultimate security

MoneyCollect's security system has obtained the highest level of PCI-DSS certification, ensuring that all payment data is strictly encrypted during transmission. In addition, MoneyCollect has a built-in powerful anti-fraud system to detect and block suspicious transactions in real time, protecting companies from potential risks.

Rich payment methods

MoneyCollect supports mainstream payment methods in more than 150 countries around the world, whether it is credit cards, e-wallets or bank transfers, it can be solved in one stop. This diverse payment option not only improves the payment convenience of customers, but also helps companies expand into international markets.

Global team and localized support

MoneyCollect has an experienced international team distributed in multiple countries, which can provide companies with 24/7 global support. In addition, its localized services also ensure that companies operating in different countries can enjoy fast response and personalized services.

Successful case demonstration

Many well-known global companies have significantly improved cross-border payment efficiency by integrating MoneyCollect API. For example, after introducing MoneyCollect, a cross-border e-commerce company successfully increased its payment conversion rate by more than 20% and effectively reduced customer churn due to payment failures.

Summary

Apple Pay provides users with a safe and reliable payment platform with its powerful encryption technology, biometric verification and privacy protection. Although the buy now, pay later service has been terminated, Apple Pay is still an indispensable tool for daily consumption. For companies that want to expand into the international market, MoneyCollect is undoubtedly a trustworthy global payment gateway that helps companies seamlessly process cross-border transactions and improve payment efficiency.

Whether it is an individual user or a company, choosing a safe and efficient payment method is an important step to ensure the smooth completion of the transaction. Apple Pay and MoneyCollect, each in different ways to escort our payment.