The world needed faster and more efficient ways to transfer money from one country to another for personal and business matters. Conventional banks are also good, but the fees are higher, and processing time is also from days to weeks. With the growing need for cross-border payments, service providers thought of digitalization, which revolutionized the payment remittance industry.

Sending money overseas has always been a hectic task for businesses and individuals. Money transfer agents and conventional banks were slow and ineffective. The money transfer market needed a complete transformation with the integration of digital payment remittance methods.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Support

- Secure Transactions

- Quick Integration

Get started

Contact sales

Overview of Money Transfer Market

There are several financial services in the global money transfer market, and payment remittance is one of them. At larger, the money transfer market includes bill payments, online purchases, local and international money transfers, remittances, and online transactions. Digitalization of the industry followed the conventional flow but made the whole process faster, more convenient, and more efficient.

Even online businesses can now accept payments from their international clients or customers. Expansion of the business beyond borders is now possible with scalable and cost-effective payment processing services. Imagine you have a subscription-based platform where international customers and users can also register.

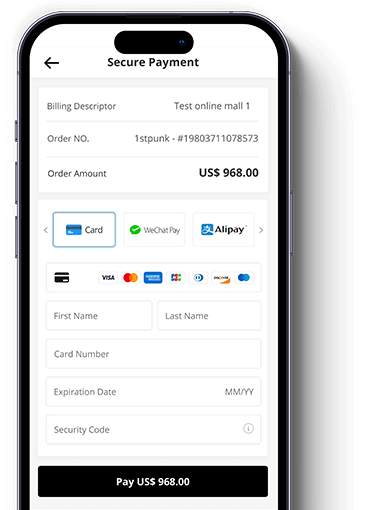

No customer is going to pay for your product or service via bank deposit or money transfer agents. Visiting the physical location of the money transfer agents will push your customers away. With modern payment processing solutions like MoneyCollect, an international payment remittance facility can be added to your online store or site.

Recommended article:How to Increase Sales Using Free Invoice Simple Templates Online - Full Guide from MoneyCollect

Impact of Digitalization on the Remittance Industry

Millions of people send money to their families back home, and they find it quite hectic to go through banks and money transfer agents. These expensive solutions have been replaced by digital payment remittance companies that offer quick transactions. How did the industry change after the digitalization?

Apparently, seamless transactions across borders became possible with these payment processing services. Here is everything you need to know about the impact that goes unnoticed by most users.

Convenience and Speed

Near-instant payments are now possible with digital payment platforms. Unlike banks and conventional channels, users don’t need to wait for days and weeks for the transfer of remittance. Within minutes, the receiver will have the money in the account.

Senders also don’t need to visit any physical shop or bank to make payments. They can initiate payment through their credit or debit cards and e-wallets. Starting a similar payment remittance company or business is also possible with the integration of the right payment solution. How does MoneyCollect facilitate acceptance of 150+ payment methods for online platforms? Get in touch with us to begin the integration of smart solutions for your business.

Reduced Costs

As there are not many parties involved in the payment processing, the additional charges have also been reduced. Banks and agents charge hefty amounts, while most digital platforms for sending remittances have fixed rates and transparent pricing.

Senders don’t have to waste their hard-earned money on additional costs and unnecessary charges. Businesses can also get rid of higher operational costs by using MoneyCollect's payment processing system. Now, your store can also accept payments from domestic and international clients.

Security and Transparency

Usually, bank transactions are not easy to track, and you will have to visit the bank to learn the current status of the payment. With online payment remittance services, transactions are processed within minutes. Even if there is a delay, you can easily track the current status of your payment.

When it comes to security, agents don’t offer accurate exchange rates for international payments. Users complain about wrong exchange rates offered by such agents. Via online platforms, you get competitive rates based on the market situation. Comparing one service against others is also easier online.

Seamless Integration

Here is the biggest perk when choosing a payment processing solution. Any new or existing business can integrate digital solutions into the current infrastructure without any major makeover. In the case of MoneyCollect, our engineers have mainly focused on the seamless integration of the technology into any type of online platform.

From online stores and sites to subscription-based platforms, every site or site can be integrated with MoneyCollect. If you ever face any trouble integrating our product, an experienced team of experts is available to entertain your queries.

Optimize financial aspects of Business with MoneyCollect

The far-reaching and profound impact of digitalization on the payment remittance market is visible. Not paying attention to the trending technologies can put your business out of the race. MoneyCollect offers all the essential tools and facilities to survive and thrive in competitive markets. To get your business ready to accept payments from 150+ local and global methods, We recommend registering with MoneyCollect to leverage these benefits firsthand.