Are you anxious about your high risk merchant account at highriskpay.com? Are you worried about becoming a high risk merchant account after a transaction suddenly? This article will answer all your questions about high risk merchant account, and provide effective solutions as well.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

What is a High Risk Merchant Account?

A high risk merchant account refers to merchant who is assessed as high risk due to their past transaction records being considered abnormal and potentially causing losses to both parties or the bank. This assessment is usually done by banks or payment service providers.

You can check on certain websites, like highriskpay.com or other public websites whether it is considered a high risk merchant account. But it is also possible to encounter reminders about high risk merchant accounts that suddenly pop up during the business process, which often leads to the transaction process being unable to continue.

Why Become a High Risk Merchant Account?

1. Abnormal transaction records

Payment behavior in multiple currencies, no valid transaction records after activation, large transaction, frequent payments and refunds result in losses for banks or financial institutions.

2. Industry reasons

Since certain reasons, merchants in specific industries are more likely to become high risk merchant accounts. For example, tourism, gambling, e-commerce, online dating, second-hand or pawn shops, and so on.

3. High risk contacts

Transactions with other high risk merchant or personal accounts can also affect your account risk rating. The background related to the responsible person of the merchant is also an important information for risk rating. It can also be said that, when the accounts of individuals or merchants closely related to you become high risk, you are also faced with this risk.

The above are three basic reasons for becoming a high risk merchant account, but the risk identification mechanism of each bank or financial institution is not exactly the same. It is very complex, closely related to merchants, banks, and payment service providers.

Tricky High Risk Merchant Processing

Once identified as a high risk merchant account, merchants will face very tricky risk management processing.

Firstly, there is a stricter review process. Merchant’s qualification, capital reserves, business maps, authenticity and compliance of transaction behavior will be audit more strictly. The process requires merchants to provide impeccable credit certificates, transaction history records, financial statements, and other supporting materials, which is very troublesome.

Secondly, a high risk merchant account has to pay a higher percentage of transaction fees and sometimes a higher amount of margin compared to a low risk merchant account.

Finally, there is a longer trading period, which is prolonged due to stricter auditing, supervision, risk identification, and many other processing.

What services are available for high risk merchant?

1. Risk consulting services

Identify risk factors in advance through risk consulting before trading to avoid high risks.

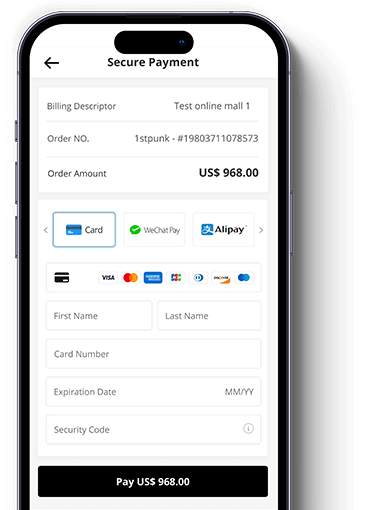

2. Payment gateway

For example, ensuring transaction security through managing payment limits, identifying fraudulent behavior, verifying information, and other methods.

3. Global payment method integration

The high risk merchant account needs to integrate payment methods in different currencies around the world, and there are some payment service providers on the market, such as MoneyCollect, have such service.

4. Risk management

Comprehensive risk control is implemented throughout the entire process of commercial transactions for all merchant accounts.

Also read: Understanding the 180-Day Calculation: A Complete Guide

Risk avoidance: How does MoneyCollect safeguard merchants?

MoneyCollect, as a safe and professional online payment platform, meets the needs of merchants in high risk industries through the following methods.

Support multi currency payments:MoneyCollect supports over 100 local payment methods and local currencies, in this way, avoids high risks caused by frequent changes in payment methods.

Prevent account theft: Utilize AI big data models to prevent account theft and ensure the security of merchant accounts.

Prevent fraud: MoneyCollect’s payment module supports 3D-Secure, ensuring fund security, effectively preventing fraud, and improving authorization rates.

Simplify transaction process: MoneyCollect provides simpler financial operation functions, optimizes processes to reduce costs, and high risk merchants no longer need more complex processing.

Customized API integration:By providing API solutions tailored to high risk merchants, MoneyCollect can help them better control costs and risks.

You may like: How to Get Free Shein Gift Cards? Everything About It

Conclusion

High risk merchant account is a tricky problem that many businesses may encounter, and its identification mechanism is too complex. As a merchant, it is difficult to completely avoid. Once regarded as a high risk merchant account, it will have a serious impact on transaction behavior, and merchants will face stricter audits, higher fees, and so on. MoneyCollect as a professional payment service provider, can effectively help merchants avoid risks and provide customized payment services.

Whether you are feeling anxious about a high risk merchant account or worried about potential high-risk issues in the future, you can visit MoneyCollect official website and get solutions with just one click. You will experience globally integrated, streamlined, secure and reliable electronic payment services.