The prime purpose of integrating smart payment service providers is to ensure that every payment is processed seamlessly. Payer and payee don’t have to worry about the transactional errors and issues. The client gets to pay using any method or currency, and the store owner gets funds deposited in the currency of his choice.

A generic payment processing tool or solution may get the job done for local clients. You will not be getting the full control, but it will make the process work. Things get complicated when international payments also need to be processed. Any business that entertains local and international markets should opt for scalable payment service providers that can handle the growing clientele and transactional load.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

What is Payment Processing?

Payment processing is a set of different actions that are triggered when a business transaction occurs between buyers and sellers. From accepting the customer’s card to communicating with the bank and adding funds to the seller’s account, many actions contribute to the payment processing.

75% of the online sales are made using different digital payment methods. While running an online business, you will have to handle hundreds of payment methods. There is no manual way to make it happen. So, a complete solution is in place for businesses, and this entire infrastructure to handle finance is called a payment processing solution.

Parties involved in Payment Processing

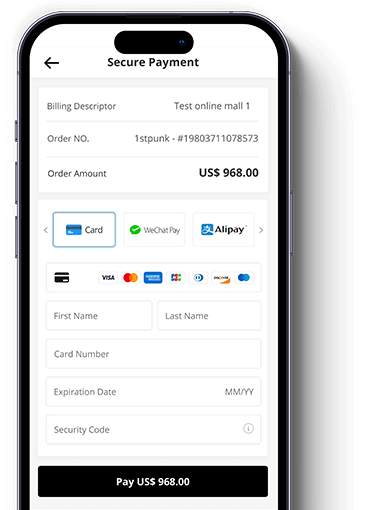

MoneyCollect is a cost-effective payment processing solution for businesses and online stores that want to facilitate local and international payments. With support from more than 100+ currencies and 150+ payment methods, MoneyCollect is leading the payment service market. Our partners need to pay a fixed price for the integration of our smart and scalable solution, but we are not the only ones handling the transactions. There are different other parties involved, including:

Customer: a person who made the purchase and chose to pay with a digital payment method

Merchant: seller (you) who is accepting the payment via card or e-wallet or any other method

Payment gateway: this is the secure connection between the payment processor and the checkout stage

Payment processor: The payment service provider (MoneyCollect) is the party that communicates with the bank, confirms the availability of funds, and then accepts or rejects the payment.

Issuing bank: it is the customer’s bank from where funds will be transferred.

Acquiring bank: it is the seller’s bank where funds will be deposited if the transaction is successful.

Depending upon the payment mode, these players may vary a little bit, but the overall working remains the same. For credit and debit cards, working might be a little bit different from the e-wallet transactions. All of these processes are carried out smoothly in the background within seconds by the payment processor or payment service provider.

Recommended article:https://www.moneycollect.com/blog/payment-service-provider

Flow of the Payment Processing

PSPs have different security protocols and safety measures in place with added layers of security. Fraud prevention is also a major concern for modern service providers. Every payment processed must be validated and verified by the issuer’s bank to avoid any possible scam. Here are some common steps of a common payment processed via MoneyCollect or any other top-tier PSP:

1. Initiation

2. Authentication

3. Processing

4. Authorization

5. Settlement

A seamless transaction is carried out when every step of the process goes smoothly, and the buyer has to face no error or problem regarding his purchase. As a businessman, you don’t need to worry about the complexity of the process because these steps are managed by MoneyCollect. Once the solution is integrated into your online store or site, your customers can pay using any type of payment mode, including credit and debit cards, bank deposits, and other types of popular digital or e-wallets.

Smooth Payment Processing for Business Growth

Cart abandonment is the biggest challenge in the growth of online businesses. Despite having quality products, businesses fail to generate the desired revenue. When customers face any issue or error at the checkout, they don’t wait for your response. They immediately abandon the cart and go somewhere else.

Any business that is facing a high rate of card abandonment should consider optimizing the checkout process. MoneyCollect not only offers a smooth checkout process, but customers can save their card details during the process for future purchases.

Contact us for Seamless Payment Processing.

Even with little or no technical or financial knowledge, any businessman or entrepreneur can get started with MoneyCollect payment processing facilities. API is designed to accept 150+ local and global payment methods. It’s time to upgrade your business structure with technologies and services that deliver the promised results. Contact us now for transparent pricing and cost-effective payment processing service for online stores, subscription-based sites, or any platform where you need to accept payments.