In today's globalized economy, cross-border payments have become an essential aspect of international trade and commerce. With the rise of e-commerce and online marketplaces, businesses and consumers alike are engaging

in cross-border transactions more frequently than ever before. However, navigating these transactions can be complex and challenging, especially when dealing with different currencies, regulations, and payment systems. In

this article, we will explore the ins and outs of cross border payments, their importance, and provide valuable tips for businesses and consumers.

What are Cross-Border Payments?

Cross-border payments refer to the transfer of funds between two parties located in different countries. This can include transactions between businesses, individuals, or a combination of both. Cross-border payments can be

made through various channels, such as wire transfers, credit cards, or online payment platforms.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Support

- Secure Transactions

- Quick Integration

Get started

Contact sales

What does Cross-Border Mean?

The term "cross-border" refers to transactions or activities that take place across national borders. In the context of payments, cross-border means that the payment is being made between two parties located in different countries.

What is the Cross-Border Payment Process?

The cross-border payment process typically involves the following steps:

1. Initiation

The payer initiates the payment by providing the required information, including the recipient's name, address, and bank account details.

2. Currency Conversion

The payment is converted into the recipient's local currency, if necessary.

3. Clearing and Settlement

The payment is cleared and settled through a network of banks and payment systems.

4. Delivery

The payment is delivered to the recipient's bank account.

Why are Cross-Border Payments Important?

Cross-border payments are crucial for international trade and commerce. They enable businesses to expand their reach globally, access new markets, and tap into new customer bases. For consumers, cross-border payments provide access to goods and services from around the world. In addition, cross-border payments facilitate international money transfers, allowing individuals to send money to family and friends abroad.

Tips for Businesses

· Use a reputable payment processor

Choose a payment processor that specializes in cross-border payments and has a strong network of banking relationships.

· Understand foreign exchange rates

Be aware of the exchange rates and fees associated with cross-border payments to avoid unexpected costs.

· Comply with regulations

Familiarize yourself with the regulations and laws governing cross-border payments in the countries you operate in.

· Consider alternative payment methods

Offer alternative payment methods, such as e-wallets or online payment platforms, to simplify the payment process for international customers.

Tips for Consumers

· Research and compare fees

Compare the fees and exchange rates offered by different payment providers to get the best deal.

· Use a secure payment method

Use a secure payment method, such as a credit card or online payment platform, to protect yourself from fraud.

· Be aware of exchange rates

Understand the exchange rates and fees associated with cross-border payments to avoid unexpected costs.

· Check the recipient's information

Verify the recipient's information, including their name and bank account details, to ensure the payment is delivered correctly.

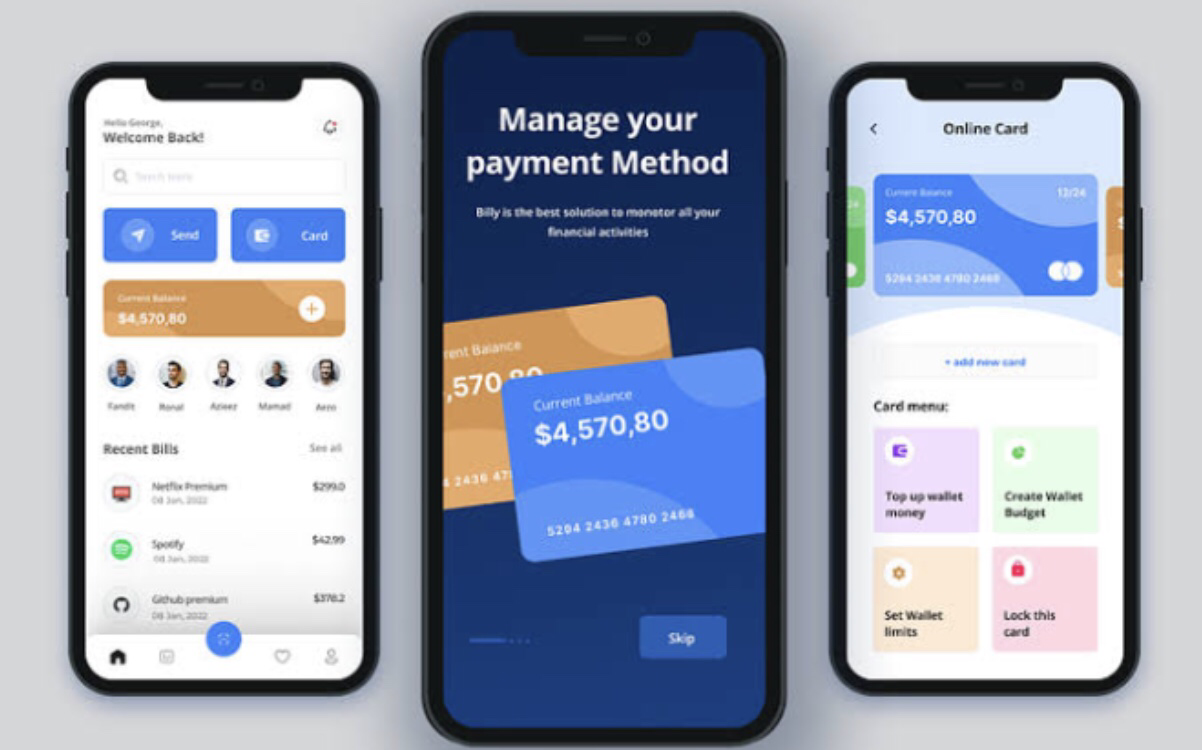

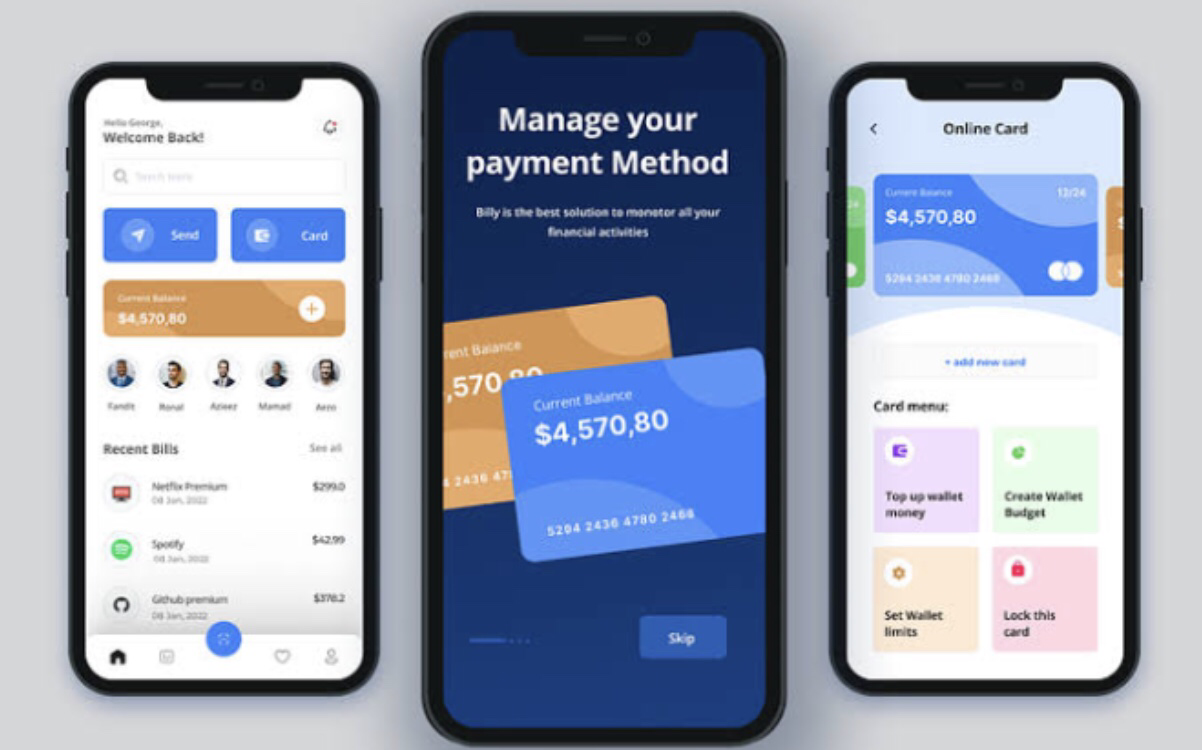

A Secure and Convenient Digital Payment Solution

In today's digital age, mobile wallets have revolutionized the way we make payments. MC Wallet is a cutting-edge digital payment solution that offers a secure, convenient, and hassle-free way to manage your finances. With MC Wallet, you can store your credit or debit card information, make online and offline payments, and track your transactions all in one place. MC Wallet is a secure, convenient, and user-friendly digital payment solution that simplifies your financial management. With its advanced security features, ease of use, and multi-card support, MC Wallet is the perfect choice for anyone looking to streamline their payments and stay on top of their finances.

Benefits of Using MC Wallet

1. Streamlined payments

Make quick and easy payments online and offline.

2. Reduced fraud risk

MC Wallet's secure tokenization and encryption minimize the risk of fraud.

3. Increased convenience

Access your cards and make payments from your mobile device.

4. Improved financial management

Track your transactions and stay on top of your spending.

5. Rewards and offers

Receive exclusive rewards and offers from participating merchants.

What Makes MC Wallet Different?

MC Wallet has several special features that make it stand out from other digital wallets. It includes MC Wallet is accepted by a wide range of merchants, both online and offline, giving you more flexibility and convenience. It

offers dedicated customer support, assisting with any issues or concerns. Not only this but MC Wallet uses innovative technology to provide a seamless and secure payment experience, making it a cutting-edge digital wallet.

Overall, MC Wallet's special features provide a unique combination of security, convenience, and financial management tools, making it an attractive option for those looking for a reliable and user-friendly digital wallet.

Ending Remarks

Cross-border payments are an essential aspect of international trade and commerce. By understanding the process, importance, and tips for navigating cross border payments, businesses and consumers can simplify the

payment process, reduce costs, and expand their global reach. Visit (link unavailable) to learn more about cross-border payments and how to make the most of your international transactions.