For both individuals and businesses, the task of managing finances has become more convenient over time. Previously, people used to get confused and speculate Can I open a bank account without depositing money? Or Can I open a bank account online without visiting? But one of the most impactful changes is that an individual can now open a bank account online with no deposit without visiting a bank. For those seeking to open a bank account online with no deposit, we will guide you carefully and outline each step ensuring comprehension and preparation for what lies ahead.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Support

- Secure Transactions

- Quick Integration

Get started

Contact sales

Comprehending the Process

To begin with the process, it is crucial to comprehend the notion of an open bank account online no deposit. Ordinarily, financial institutions mandate that you put in some minimum sum while setting up your account; however, several current-age banks - specifically those operating digitally - have done away with this prerequisite to attract more clients. Consequently, now you can initiate and operate your profile without making any initial fund transfers.

Recommended article:Impact of Digitalization on Payment Remittance

Why Choose to Open Bank Account Online Free No Deposit?

1. Convenience

Opening an account from the convenience of your residence.

2. Accessibility

Banking is accessible to everyone, without having the obligation of meeting minimum deposit requirements.

3. Speed

In just a few minutes, the whole process can be finished.

4. Cost-Effective

Based on your credit history or personal information.

5. Video Verification

Some banks might require a short video call to confirm your identity.

Review and Submit Your Application

Before submitting your application, review it for accuracy once you have completed all required tasks. Following submission, expect to receive a confirmation email or message shortly afterward.

Advantages of Online Banks with No Deposit Requirement

1. Lower Fees

Customers can enjoy lower fees with online banks due to their lesser overhead costs.

2. High-Interest Rates

Online banks generally provide greater interest rates for savings accounts in contrast to customary banks.

3. Innovation

Online banks often offer advanced features such as budgeting tools, financial insights, and effortless integration with other finance apps.

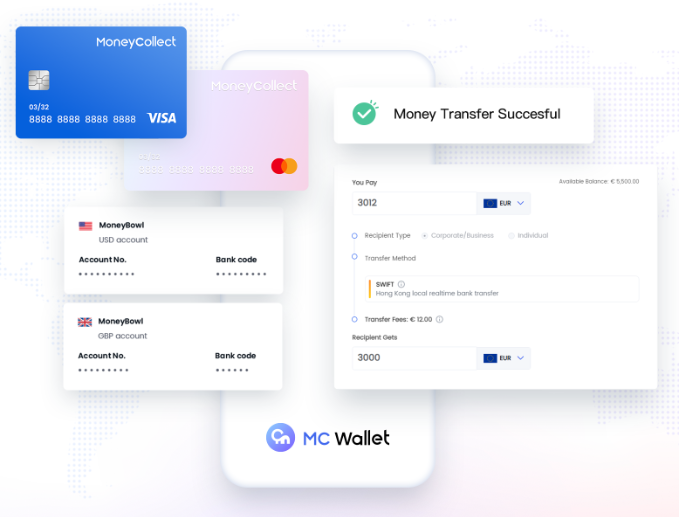

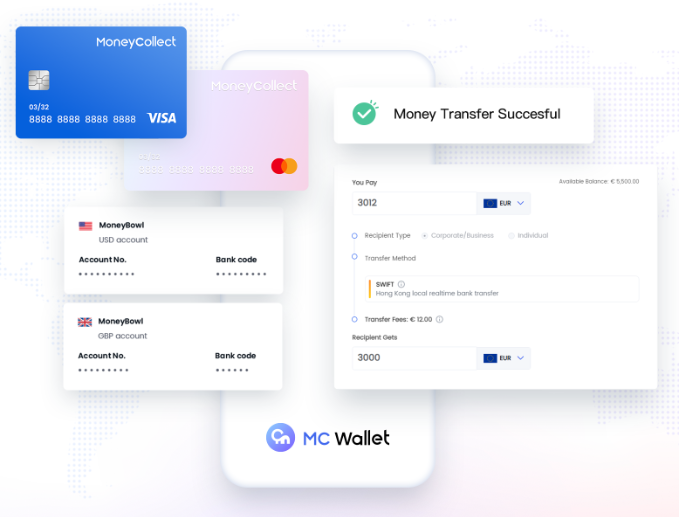

MoneyCollect: Revolutionizing Financial Management

MoneyCollect is providing businesses with efficient payment solutions. MoneyCollect offers seamless integration with your online bank account, providing individuals with a hassle-free method of managing their payments and transactions. Whether you're a freelancer striving to streamline the invoicing process or a small business seeking dependable payment processing solutions, MoneyCollect equips you with the necessary tools to optimize financial operations.

Reduces expenses for travel and possible upfront charges.

Guide to Open Bank Account Online No Deposit

Research and Choose the Right Bank

You might be curious about what bank can I open an account online without a deposit? To begin, research banks that provide the opportunity to open bank account online no opening deposit. Take into consideration various aspects including:

● Fees

Search for banks that have minimal or zero monthly maintenance charges.

● Features

You must make sure that the bank caters to your requirements by providing services like mobile banking, ATM availability, and efficient customer assistance.

● Reputation

To ensure the dependability and credibility of a financial institution, validate its ratings and feedback.

Gather Necessary Documentation

Although it is possible to open bank account online no deposit, you must still furnish certain information to verify your identity. Some examples of commonly requested documents are:

● Personal Identification

An ID issued by the government, for instance, a passport or driver's license.

● Social Security Number

For identity verification.

● Proof of Address

Utility bills or lease agreements to confirm your residential address.

Visit the Bank’s Website or App

Once you've chosen a bank, simply visit its website or download the app and locate either "Open an Account" or "Get Started." These options will walk you through applying for your account.

Fill Out the Application

The application will ask for:

● Personal Information

Contact information, full name with date of birth, and Social Security number.

● Employment Information

One must indicate his present employment status and, if relevant, furnish particulars regarding his employer.

● Account Preferences

Select the account category that suits your requirements (either checking, savings, or both) along with any extra functionalities you may require.

Verify Your Identity

Verifying your identity will be required following the submission of your application. The steps involved in this process may vary but typically entail:

● Uploading Documents

Scan or photograph your ID and proof of address.

● Answering Security Questions

As a top financial technology company, our array of services encompasses:

Payment Processing

Allowing businesses to effortlessly receive payments through diverse channels, encompassing credit cards, debit cards, and online banking.

Global Reach

With its ability to accommodate various currencies and payment options, MoneyCollect is the perfect solution for companies catering to a global clientele.

Security

MoneyCollect safeguards businesses and their customers from fraudulent activities by implementing reliable security measures for all transactions.

Analytics

MoneyCollect provides businesses with valuable data analytics to gain an understanding of their financial performance and customer behavior.

Summing Up

If you're in search of a convenient and flexible means to manage your finances, then to open bank account online no deposit is an outstanding option. This approach caters perfectly well to young professionals just starting on their career journey or anyone seeking better ways of handling money matters.