As a well-known major player in the payment industry, PayPal offers a range of services and solutions for business accounts. Nonetheless, a few commercial users have expressed dissatisfaction with PayPal's risk control and after-sales care. Instead, because to its exceptional after-sales support and adaptable policies, MoneyCollect has steadily gained the trust of an increasing number of businesses. This post will go over the various PayPal business account product kinds in depth, look at some of their drawbacks, and outline the unique benefits of MoneyCollect.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Support

- Secure Transactions

- Quick Integration

Get started

Contact sales

1. Product Types of PayPal Business Accounts

PayPal Checkout: Businesses can accept credit cards, debit cards, and local payment methods in addition to other payment options online by using PayPal Checkout. The payment experience for clients can be quickly enhanced with this function, which is also straightforward to integrate.

Pay using PayPal here: This mobile payment solution, which is appropriate for companies with brick-and-mortar storefronts or on-the-go services, enables them to take payments from customers using smartphones or tablets on-site.

PayPal Invoicing: This service streamlines bill management by letting companies issue expert electronic invoices and letting clients easily finish payments online.

The PayPal Business Debit MasterCard gives businesses more freedom over how they use their money by enabling them to access funds straight from their PayPal account and earning cash back on eligible purchases.

PayPal Credit: Businesses can boost sales by providing clients with a credit line, which incentivizes them to make more transactions.

PayPal Commerce Platform: Whether a company utilizes its own website or a third-party e-commerce platform, this platform smoothly interfaces with online businesses and marketplaces to expedite payment processing and order administration.

PayPal facilitates the integration of diverse shopping cart software, so enabling enterprises to effortlessly incorporate payment alternatives and enhance the overall purchasing encounter.

Financial instruments and international payments

Working Capital Loans: To assist businesses in meeting short-term finance needs, PayPal offers working capital loans with a short repayment period depending on a company's sales history.

Multi-currency accounts: Make it easier for companies to conduct international transactions by enabling them to hold, transfer, and receive multiple currencies.

Cross-Border Transactions: To make cross-border sales easier, offer local payment options and currency conversion.

Fraud and risk management

Advanced Fraud Protection Tools: These tools assist companies in guarding against fraudulent activity and unlawful transactions while maintaining transaction security.

Seller Protection: By preventing fraudulent transactions and goods that are not received, the Seller Protection Program lowers chargebacks and reversals.

Subscriptions and recurring payments

Subscription billing is a useful tool for subscription-based organizations as it helps them set up and handle recurring payments.

2. Defects of PayPal

PayPal may be widely used, but customers frequently complain about the poor quality of their after-sales support. When customers have issues, a lot of them complain that customer care is unprofessional and takes a long time to respond. For businesses who have urgent issues to resolve, this is a major issue.

Strict risk control policy

Many business customers of PayPal say that their accounts are frequently stopped or canceled without apparent reason. PayPal has very strong risk control standards for accounts. This will lead to a number of operational issues in addition to having a significant negative impact on the company's capital flow.

PayPal charges very high handling fees, particularly for cross-border transactions. In addition, the corporation must pay service fees and currency rate conversion expenses. This is a big cost for businesses who deal with foreign markets on a regular basis.

3. Advantages of MoneyCollect

Excellent after-sales service

MoneyCollect is renowned for providing top-notch customer support. Whatever issues the business runs into while using MoneyCollect, its customer support staff can offer quick, courteous assistance. MoneyCollect offers more prompt, courteous, and efficient after-sale support than PayPal, and it can promptly resolve consumer issues.

Flexible risk control policy

MoneyCollect ensures security while implementing a more flexible risk control policy. MoneyCollect makes it exceedingly unlikely for an account to be blocked or canceled without cause, allowing businesses to use its payment services with more confidence and prevent business disruptions due to account issues.

MoneyCollect offers a more advantageous charge schedule, particularly for international transactions, which can assist businesses in cutting costs associated with transactions. Furthermore, MoneyCollect offers free virtual Hong Kong bank account establishment, giving businesses additional options for managing their funds.

Diversified payment solutions

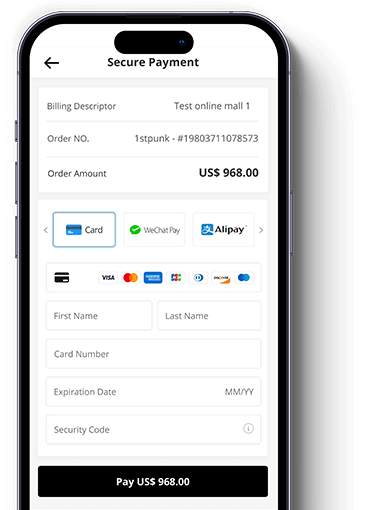

In addition to supporting conventional payment methods, MoneyCollect offers a number of cutting-edge payment API services to cater to the various needs of businesses. MoneyCollect can offer comprehensive solutions to assist businesses increase payment efficiency and customer happiness, whether it be through online, mobile, or subscription services.

conclusion

In conclusion, even though PayPal is a major payment corporation and offers a range of business account products encompassing e-commerce solutions, merchant services, payment processing, and other areas, its stringent risk control standards and poor after-sales support frequently cause issues for consumers. Discomfit and danger. On the other hand, a growing number of businesses are finding that MoneyCollect is the best option because of its excellent post-purchase support, adaptable risk management guidelines, and affordable handling costs. Businesses who choose MoneyCollect can save expenses and boost operational effectiveness in addition to receiving convenient and safe payment services. MoneyCollect is without a doubt the wise option for business payment solutions in the fiercely competitive market environment of today.