Google Pay is a practical and safe payment option that is becoming more and more popular among consumers in the contemporary digital payment landscape. But occasionally, in order to settle disputes or guarantee payment security, we must follow a transaction. This post will explain how to keep track of your Google Pay transaction history and, when applicable, will include a mention of MoneyCollect, a top-notch payment provider.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Support

- Secure Transactions

- Quick Integration

Get started

Contact sales

1. Track transaction history through the Google Pay app

First, launch your smartphone's Google Pay app. Use your Google account to log in if you're not already.

Access transaction history

Choose "View all transactions" from the "Payment" tab at the bottom of the app's main interface. You may now view all of the transaction records that were made using Google Pay.

View a single transaction in detail

Once you locate the transaction you wish to monitor, click on the transaction entry to get more specific details such as the merchant name, transaction status, amount, and date. If there is a disagreement, you can use this interface to seek a refund or get in touch with the vendor directly.

2. Track transaction records through the Google Pay website

Log in to the Google Pay website

Visit the Google Pay website in your browser and log in with your Google account.

Click "Activity" from the left menu after logging in. You may now view all of the transaction records that were made using Google Pay.

View a single transaction in detail

To access the details, click on the transaction entry that you wish to track. You can access further assistance information by clicking the "Help" option if you need it.

3. Track transactions through bank account or credit card statements

Check bank account or credit card statements

Frequently, transaction history from Google Pay will also show up on your credit card or bank statements. To verify the transaction information, review the statement and locate the pertinent transaction entries.

Contact the bank or credit card company

You can ask for transaction dispute resolution or additional inquiry directly with the bank or credit card issuer if you discover unusual transactions on your statement.

4. Payment solutions provided by MoneyCollect

It would be remiss of us not to include MoneyCollect, another successful player in the payments industry, in our discussion on Google Pay. When compared to alternative payment service providers, MoneyCollect offers the following noteworthy benefits:

Excellent customer service

MoneyCollect is renowned for providing top-notch customer support. Whatever issues the business runs into while using MoneyCollect, its customer support staff can offer quick, courteous assistance. On the other hand, MoneyCollect's post-purchase assistance is more thoughtful, prompt, and capable of resolving issues for clients with speed.

Flexible risk control policy

MoneyCollect maintains security while implementing a more accommodating risk management strategy. MoneyCollect's account freezing and closure policies are incredibly rare, allowing businesses to use its payment services more securely and prevent account issues from disrupting corporate operations.

MoneyCollect offers a more advantageous handling charge policy that can assist businesses cut costs associated with transactions, particularly in cross-border transactions. To give businesses more options for managing their funds, MoneyCollect also offers free virtual Hong Kong bank account settings.

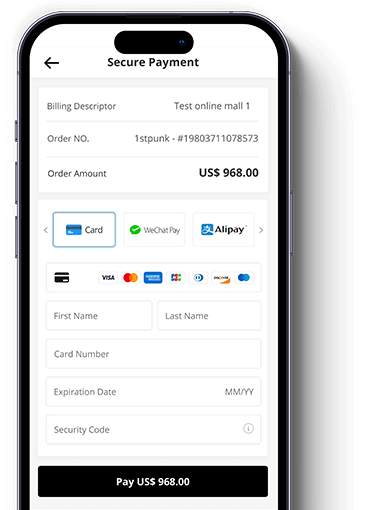

Diverse payment solutions

In addition to offering a range of cutting-edge payment API services, MoneyCollect covers conventional payment methods in order to accommodate the various demands of businesses. MoneyCollect offers a range of complete solutions to enhance payment efficiency and customer happiness for businesses, whether it be through online, mobile, or subscription services.

5. Global coverage and localized support

In order to support businesses in operating efficiently in various markets, MoneyCollect offers both regional payment solutions and a broad worldwide payment network. MoneyCollect is a dependable source for support and services when handling domestic and international payments.

Conclusion

An essential first step in ensuring payment security and resolving disputes is tracking Google Pay transaction logs. The specifics of each transaction are easily accessible through the Google Pay app, website, and statements from your bank account or credit card. MoneyCollect is a payment system that offers a higher level of security and flexibility. They can offer businesses services that enhance the payment process overall and aid with tracking and managing transactions more effectively. Securing your organization with the correct payment tools and service providers will increase convenience and security in the quickly evolving digital payment era.