In the dynamic landscape of e-commerce, understanding various payment methods is crucial for both consumers and businesses. One such method is the ACH transfer, which offers a secure and efficient way to move money between accounts. This article delves into what ACH transfers are, how they work, and their benefits. We will also introduce MoneyCollect and how it enhances online transactions for e-commerce platforms.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

What Is an ACH Transfer?

An ACH transfer is an electronic, bank-to-bank money transfer processed through the Automated Clearing House (ACH) Network. This network is a batch processing system that banks and other financial institutions use to aggregate these transactions for processing.

Key Takeaways

Electronic Transfers: ACH transfers are bank-to-bank money transfers processed through the Automated Clearing House Network.

Direct Deposits: Transfers into an account, such as payroll, benefits, and tax refund deposits.

Direct Payments: Money going out of an account, including bill payments.

Transaction Limits: There may be limitations on the number of ACH transactions you can initiate.

What Is ACH?

The ACH Network, or Automated Clearing House Network, is a system in which funds are electronically transferred from one party to another. ACH transfers allow for safe money transfers online, such as for direct deposits or bill payments.

Types of ACH Transfers

ACH transfers can make life easier for both the sender and recipient. They allow you to send and receive money conveniently and securely without ever having to leave your home. The ACH Network processes two kinds of ACH transactions: direct deposits and direct payments.

ACH Direct Deposits

An ACH direct deposit is any kind of electronic transfer made from a business or government entity to a consumer. The kinds of payments that fit in this category include:

ACH Direct Payments

Direct payments can be used by individuals, businesses, and other organizations to send money. For example, if you’re paying a bill online with your bank account, that’s an ACH direct payment. Social payment apps such as Venmo and Zelle also use the network when you send money to friends and family.

In an ACH direct-payment transaction, the person sending the money sees an ACH debit appear in their bank account. This debit shows to whom the money was paid and for what amount. The person or entity receiving the money registers it in their bank account as an ACH credit.

Benefits of an ACH Transfer

Using an ACH transfer to pay bills or make person-to-person payments offers several advantages, starting with convenience. Paying your mortgage, utility bill, or another recurring monthly expense using an electronic ACH payment may be easier and less time-consuming than writing and mailing a check. Additionally, ACH payments can be more secure than other forms of payment.

Downsides to an ACH Transfer

Despite their convenience, ACH transfers have some drawbacks. Many banks impose limits on how much money you can send via an ACH transfer. Additionally, timing matters for ACH transfers because not every bank sends them for processing at the same time.

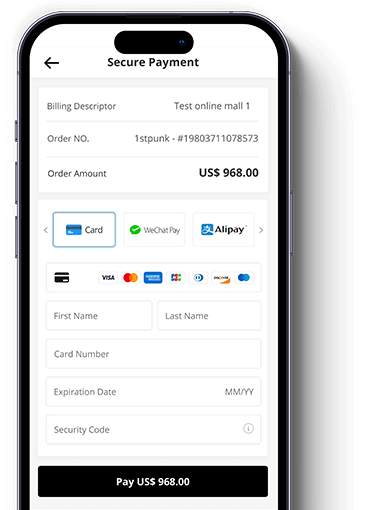

MoneyCollect’s Contribution to E-Commerce

While MoneyCollect does not specifically offer ACH transfers, it provides a wide range of other secure and efficient payment solutions tailored for e-commerce platforms. MoneyCollect supports multiple payment methods including credit cards, debit cards, and electronic wallets, ensuring that both merchants and consumers have a seamless transaction experience.

Security

By integrating cutting-edge security technologies, MoneyCollect ensures that every transaction is safeguarded, providing users the confidence they need.

Efficiency

Engineered to simplify the transaction process, MoneyCollect makes transactions quicker and less complicated, thus improving overall user satisfaction.

Cost-Effectiveness

Assisting users in navigating and managing payment fees, MoneyCollect aids in refining sales tactics, which can lead to more cost-effective transactions.

Key Features of MoneyCollect

As e-commerce continues to evolve, understanding services like MoneyCollect can help us grasp the complexities of modern e-commerce operations and the importance of optimizing payment processes to enhance the consumer experience. Whether you're a merchant looking to expand your payment methods or a consumer seeking a trustworthy payment system, MoneyCollect provides the essential tools for a seamless online payment experience.