The modern digital economy heavily relies on the ease of online payment processing for businesses and service providers. The ability to facilitate users with seamless transactions helps businesses thrive in hyper-competitive markets.

With every other online shopping site offering lucrative products and pricing, no business can afford to lose a potential customer due to slow payment processing. Complex or slow payment process flow is the primary reason behind shopping cart abandonment. Most shopping cart abandonment studies indicate that up to 69.99% of carts are abandoned at the checkout.

It is a fact that payment processing speed or availability of desired payment methods is not the only factors here, but having a swift and secure payment processing API can give a competitive advantage. Streamlining payment processing and checkout flow are the aspects that starters and small businesses ignore.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

Rapidly Evolving Online Checkout and MoneyCollect

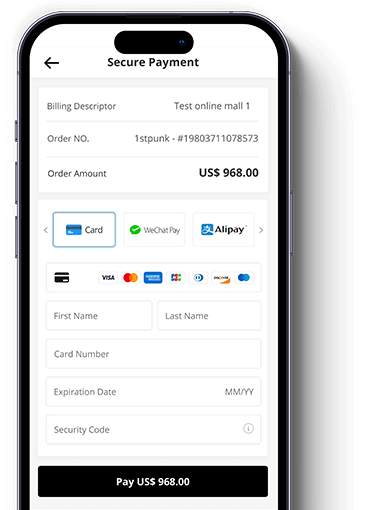

When customers feel lost in transactions or don’t feel secure sharing their confidential bank credentials, your checkout process needs revamping. Sticking with conventional payment gateways did not get you far enough. We understand the frustration, and as a solution for the online business community, we offer MoneyCollect as your chance to improve the checkout and payment process.

What is MoneyCollect?

With more than 150 local payment methods and 100+ currencies, MoneyCollect is one of the emerging payment service providers in the digital economy. Whether you own an online store, a subscription-based platform, or any other digital presence where you need to accept payments, MoneyCollect offers everything to streamline transactions for customers and you.

Easy integration for existing or new websites or apps makes it suitable for businesses of all sizes. Thousands of online stores are already onboard, and we would like your business to be a partner in this payment service revolution.

Recommended article:MoneyCollect: The Ultimate International Payment Gateway for Global Commerce

Impact of Fast Payment Process Flow

For customer-centric merchants, fast and smooth payment processing is the new frontier. There might be some payment services that offer exceptionally good transaction handling. What about the high costs of these services? How are you supposed to bring in the profits when these payment processing service providers take the major chunk? MoneyCollect is a bespoke solution for merchants wanting to keep costs minimal while getting premium services.

Optimizing sales flow is not expensive with MoneyCollect. This service is engineered for online stores and startups who want to take their online brands to the next level. How does collaborating with a trusted payment service provider make a difference in your business revenue?

Power of Fast Payment Processing

Cutting through the friction of slow payments is a challenge that we beautifully handled for our partners. We focused on the elements that increase customer retention and revenue generation for our clients. How does fast payment processing play an important role in all of this? Well, partners get to enjoy:

Implementation Considerations for Payment System API

Up to 74% of online stores and apps accept credit and debit cards as major payment methods. Alternate payment methods and local methods are also popular in the industry. More than 61% of businesses offer e-wallet payment facilities, while only 52% of them accept direct bank transfers. In every payment method, your customers expect fast processing.

Integrating MoneyCollect to your existing or new platform is easy. Still, we would like to share some actionable insights that must be considered before the integration.

Security and Compliance

In online transactions, the security of personal and financial data is the paramount concern. Steer clear of the payment service providers that don’t adhere to the industry standards and other rules and regulations like Payment Card Industry Data Security Standard (PCI DSS). Tokenization, data encryption, and other security protocols must be implemented to secure financial transactions.

Scalability

Business growth is your goal, but can your selected payment service system handle the increasing customer load and thousands of daily transactions? Scalable payment processing API will effectively accommodate the increasing volume of financial data and transactions. With predictive reports, managers can make the required adjustments related to financial matters promptly.

Cost-benefit Analysis

Ongoing fees for payment service providers can reduce the profit margins. Technology investments are essential for business operations, but conducting a detailed analysis of the cost-benefit scenario will help you choose a reliable and affordable payment process API.

Beyond Speed- Value Addition with MoneyCollect

Speed is critical for a thriving business, but a practical payment service should provide more than just fast responses. Fraud prevention tools, helpful data insights, pre-authorized payments, and ease of integration are some major benefits of having MoneyCollect as a payment service for your business. Streamlined payments are no longer a luxury, and we aim to create a checkout experience that is profitable for you and delightful for your customers.