Cross-border e-commerce is an important way for many companies to expand their markets and enhance their competitiveness. In today's globalized world, it is crucial for companies to choose the right payment service provider if they want to conduct cross-border transactions smoothly. As the world's leading online payment platform, PayPal has become the first choice for many companies due to its security and convenience. However, in recent years, another payment service provider, MoneyCollect, has also gradually gained favor among corporate users due to its powerful functions and excellent security. So, what business types does PayPal business account have? What goods and services are provided? How is the security? Why should we pay attention to MoneyCollect? This article will explore these issues in depth.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

Business types on PayPal business accounts

PayPal business accounts mainly provide corporate users with a series of payment solutions for online sales and cross-border transactions. Its business types include:

Corporate account management

PayPal business accounts provide flexible corporate account management functions. Companies can set multi-user permissions according to their own needs and specify different access rights and operation scopes. This makes it more convenient and secure for companies to manage and maintain accounts.

Online payment collection

PayPal business accounts support companies to receive payment methods from all over the world, including credit cards, savings cards, bank accounts, etc. With its wide coverage, companies do not need to worry about losing customers due to limited payment methods.

Currency conversion

PayPal provides automatic currency conversion services to convert the local currencies of both parties to the transaction. Companies do not need to operate manually, which saves time and reduces exchange costs. In addition, PayPal also provides competitive exchange rates, further improving the efficiency of capital utilization.

Transaction protection

PayPal's business account purchase protection plan provides users with additional security. Both sellers and buyers can use this plan to avoid losses due to fraud or unauthorized payment activities.

You can also read this article: PayPal Goods and Services: How It Works, Fees and More

How secure is PayPal?

Fund security is one of the most concerned issues for companies in cross-border transactions. PayPal performs well in this regard:

Encryption technology

PayPal uses advanced encryption technology during data transmission to ensure that users' financial information will not be stolen or tampered with during transmission.

Strict account verification

PayPal requires users to conduct strict account verification, including linking credit cards or bank accounts and identity verification to ensure the authenticity and security of the account.

Buyer and Seller Protection Policy

PayPal provides users with buyer protection and seller protection policies, providing users with additional security during the transaction process and minimizing transaction risks.

Payment service providers with similar products and services to PayPal

In addition to PayPal, there are many other payment service providers on the market that provide similar products and services. For example MoneyCollect, Stripe and Payssion

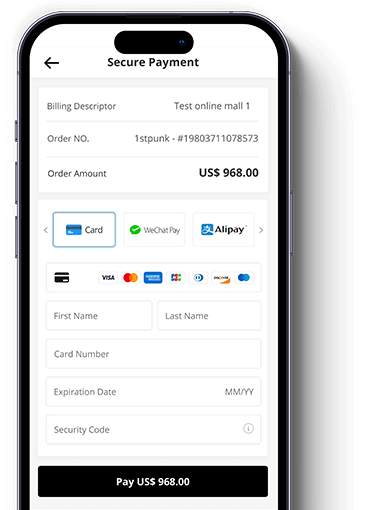

In particular, MoneyCollect, as a payment service provider focusing on cross-border payment solutions, has more comprehensive functions and security. MoneyCollect not only provides a global payment interface, but also supports multiple payment methods, covering more than 150 countries and regions. More importantly, MoneyCollect has passed the highest level of payment security certification-PCI-DSS Level 1 certification, ensuring the absolute security of the payment process.

Choose a suitable payment service provider

With its comprehensive and convenient payment solutions, PayPal Business Account has built a bridge connecting the global market for corporate users. However, when choosing a payment service provider, companies also need to consider factors such as exchange rate fluctuations in the global market and the risks of cross-border transactions. MoneyCollect is an ideal choice to meet these challenges. Through its flexible settlement methods and powerful risk control system, MoneyCollect can help companies reduce the risks of cross-border transactions, optimize global fund management, and improve cross-border transaction efficiency.

Whether to choose PayPal or MoneyCollect depends on the specific needs and market strategy of the company. In today's increasingly fierce global competition, choosing a suitable payment service provider will bring immeasurable help to the company's cross-border business.