In modern banking, ACH (Automated Clearing House Transfer) is an efficient and convenient payment method widely used in daily financial transactions of enterprises and individuals. Although ACH payment is becoming more and more popular, some users are still not very clear about its specific meaning and operation steps. Next, we will introduce the basic concepts and operation procedures of ACH in detail, and explore how to improve transaction efficiency through MoneyCollect.

Key Features:

- 150+ Local Payment Methods

- 100+ Currency Supports

- Secure Transactions

- Quick Integration

Get started

Contact sales

What does ACH mean in banking?

ACH, the full name of "Automated Clearing House Transfer", is an electronic transfer method between banks in the United States. It processes inter-bank fund transfers through an automated system and usually completes the transfer within one business day without manual intervention. This payment method greatly improves the efficiency of transfers. At the same time, compared with international wire transfers, ACH transfers have lower fees and do not require SWIFT codes. Only ABA routing numbers are required to complete transactions.

The main advantages of ACH transfers include:

Fast arrival:

usually completed within one business day, improving the efficiency of capital circulation.

Low cost:

Compared with international wire transfers, ACH transfers have lower fees, especially for large or frequent transfers.

Safe and reliable:

Transactions are processed through the interbank automated clearing system to ensure the security and reliability of fund transfers.

Easy to operate:

Users only need to provide the recipient's bank account information and ABA routing number to easily complete the transfer operation.

Operation steps of ACH transactions

ACH transactions are a payment method that transfers directly from one bank account to another. It is an efficient alternative to cash, paper checks or credit card payments. The specific operation steps are as follows:

Initiate ACH payment

Users first need to agree to initiate ACH transfers, which can be achieved by signing an ACH authorization form or recording a phone call. After authorization, users can set up one-time payments, recurring payments, or even series of payments on specific dates.

Receive ACH payments

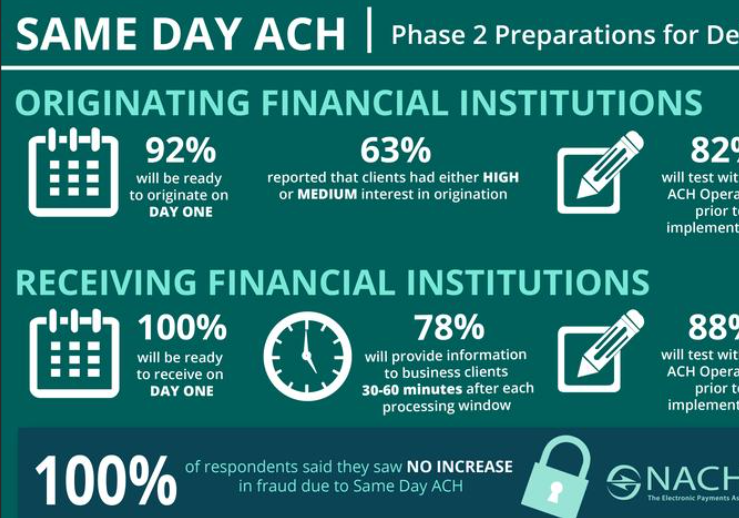

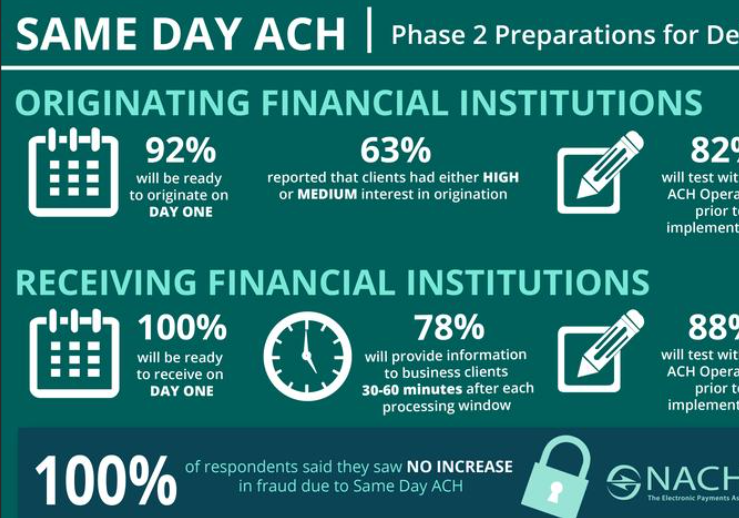

After obtaining authorization, the bank account can electronically withdraw the agreed payment from the customer's account. Under the past rules, it usually takes 3 to 5 business days to complete the transaction, but under the new rules, some ACH transactions can be processed on the same day.

Notes

During the ACH payment process, you may encounter some common problems, such as payment return due to insufficient account funds. In order to ensure that the ACH payment is successful, it is necessary to confirm that there are sufficient funds in the customer's account. In addition, merchants also need to choose a reliable payment solution to ensure that each transaction can be completed smoothly.

MoneyCollect helps merchants simplify the payment process

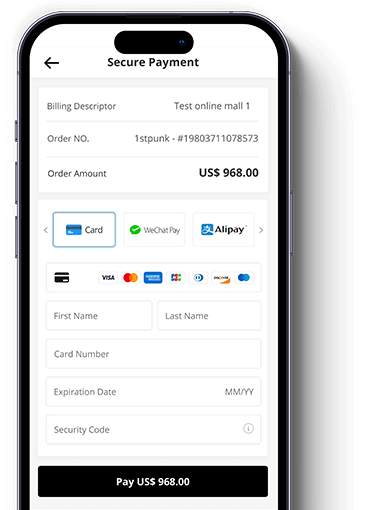

For merchants, it is crucial to ensure that payments are received smoothly. As a world-leading payment gateway, MoneyCollect provides merchants with flexible and convenient payment solutions. MoneyCollect supports multiple payment methods, helping merchants to easily process transactions from different banks and payment channels, ensuring the security and efficiency of the payment process.

MoneyCollect's core advantages:

Multi-payment method support

MoneyCollect integrates more than 100 payment methods worldwide, including credit cards, debit cards, ACH, e-wallets, etc., to help merchants meet the payment needs of different consumers.

Simplify the payment process

By integrating MoneyCollect's payment interface, merchants can greatly simplify the payment process and improve the success rate of transactions. Whether it is domestic transactions or cross-border payments, MoneyCollect can provide stable payment services.

Highly secure payment guarantee

MoneyCollect uses advanced AI technology and 3D-Secure security measures to monitor every transaction in real time, effectively prevent fraud, and ensure the safe transfer of funds.

Conclusion

As an efficient payment method between banks in the United States, ACH is gaining favor with more and more businesses and individual users. Whether it is the frequent transfer needs of enterprises or the daily payments of individuals, ACH can provide fast and secure solutions. At the same time, merchants can provide customers with more flexible payment options and enhance the overall shopping experience through payment gateways such as MoneyCollect.

By choosing MoneyCollect, merchants can not only improve transaction efficiency, but also gain competitive advantages in the global market. Make payment more convenient, secure and worry-free!