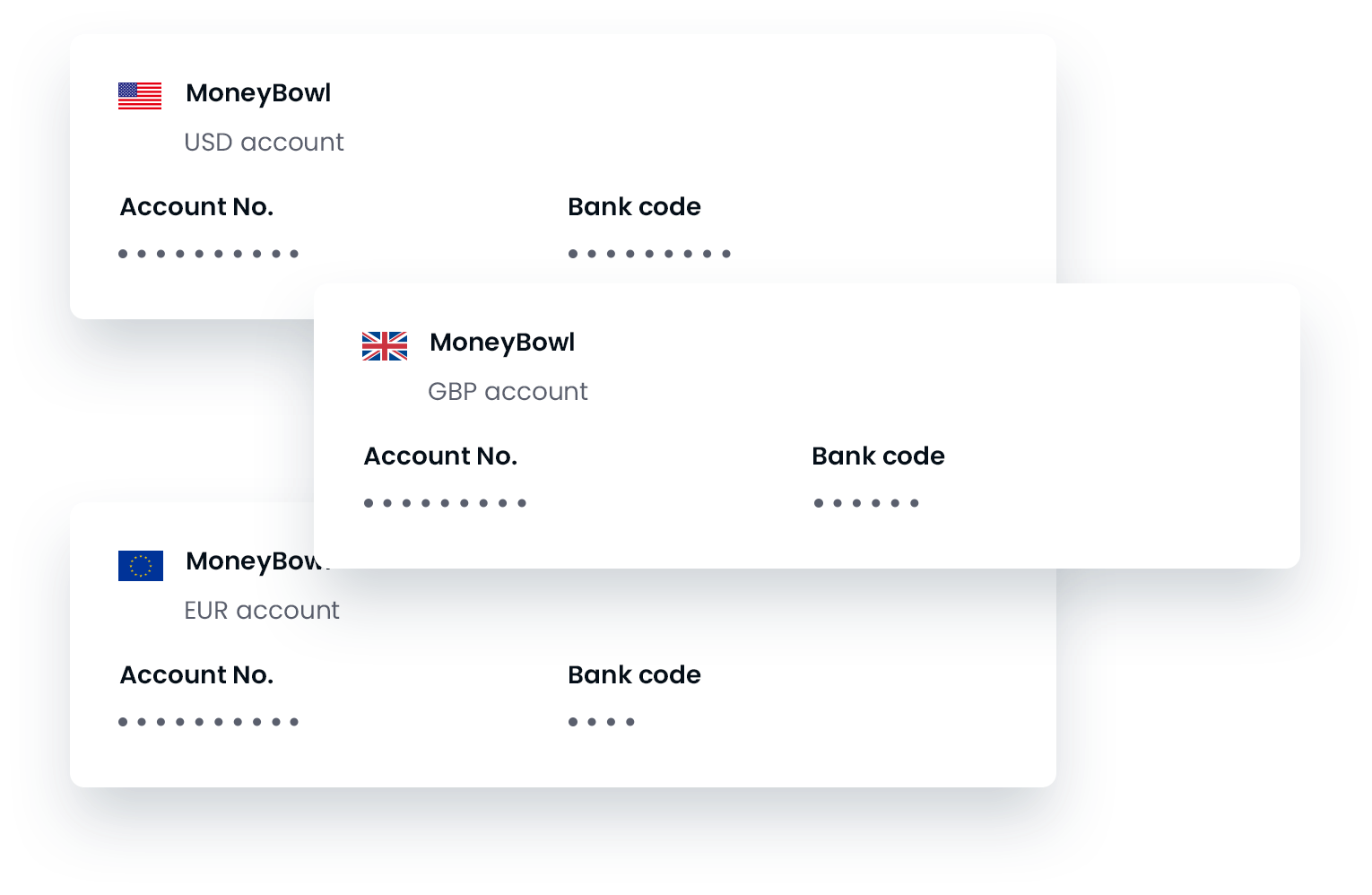

Receive payments in your customers' preferred currency and eliminate costly conversion and transaction fees with MoneyCollect’s account

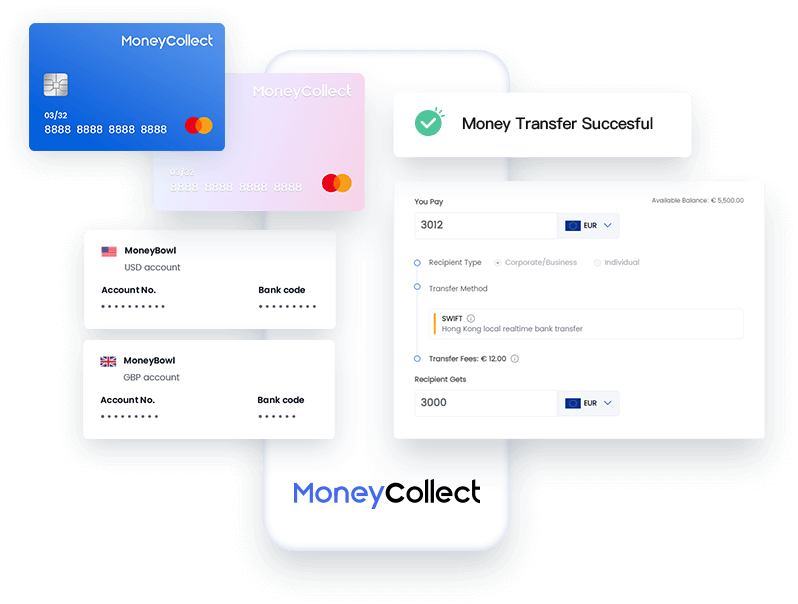

Remote Account Opening, Hassle-Free

Initiate global multi-currency accounts swiftly to commence the reception, conversion, and distribution of funds, all efficiently managed from a centralized platform.

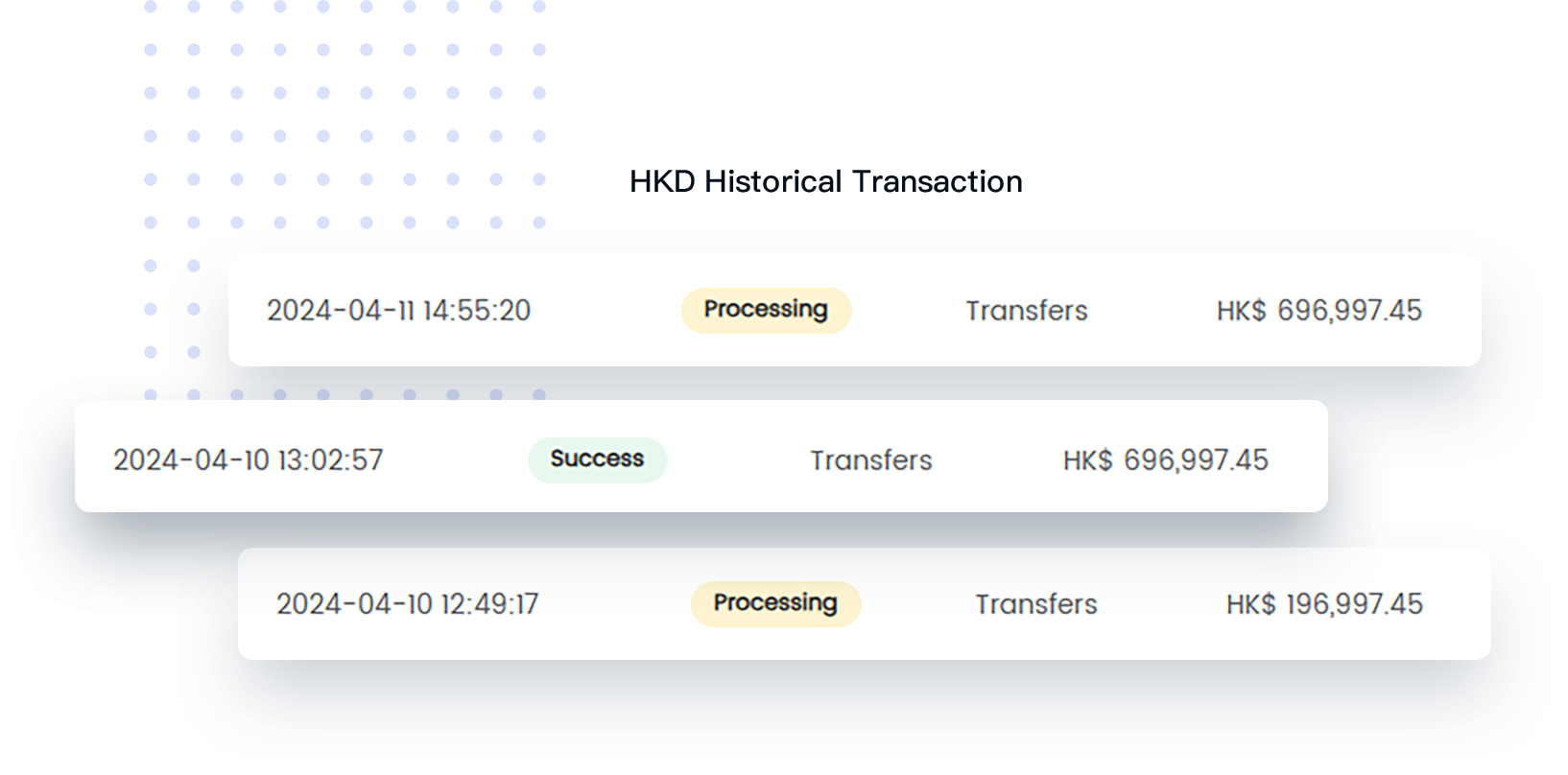

Achieve Unparalleled Liquidity and Streamlined Operations

Eliminate intricate and time-consuming accounting and reconciliation processes with consolidated reporting.

Simplified Collection Processes

Effortlessly receive transfers from multiple countries and currencies via local clearing houses, SWIFT, direct debit, or wire transfers.

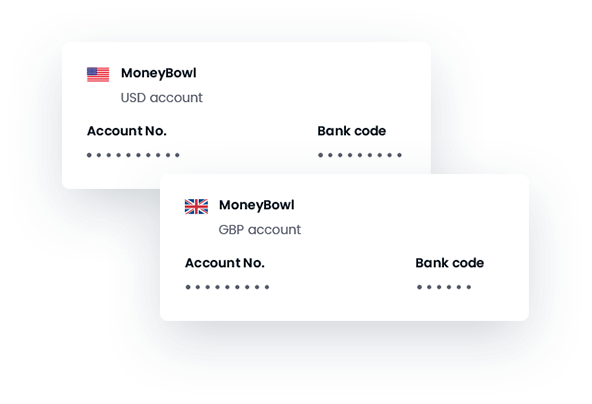

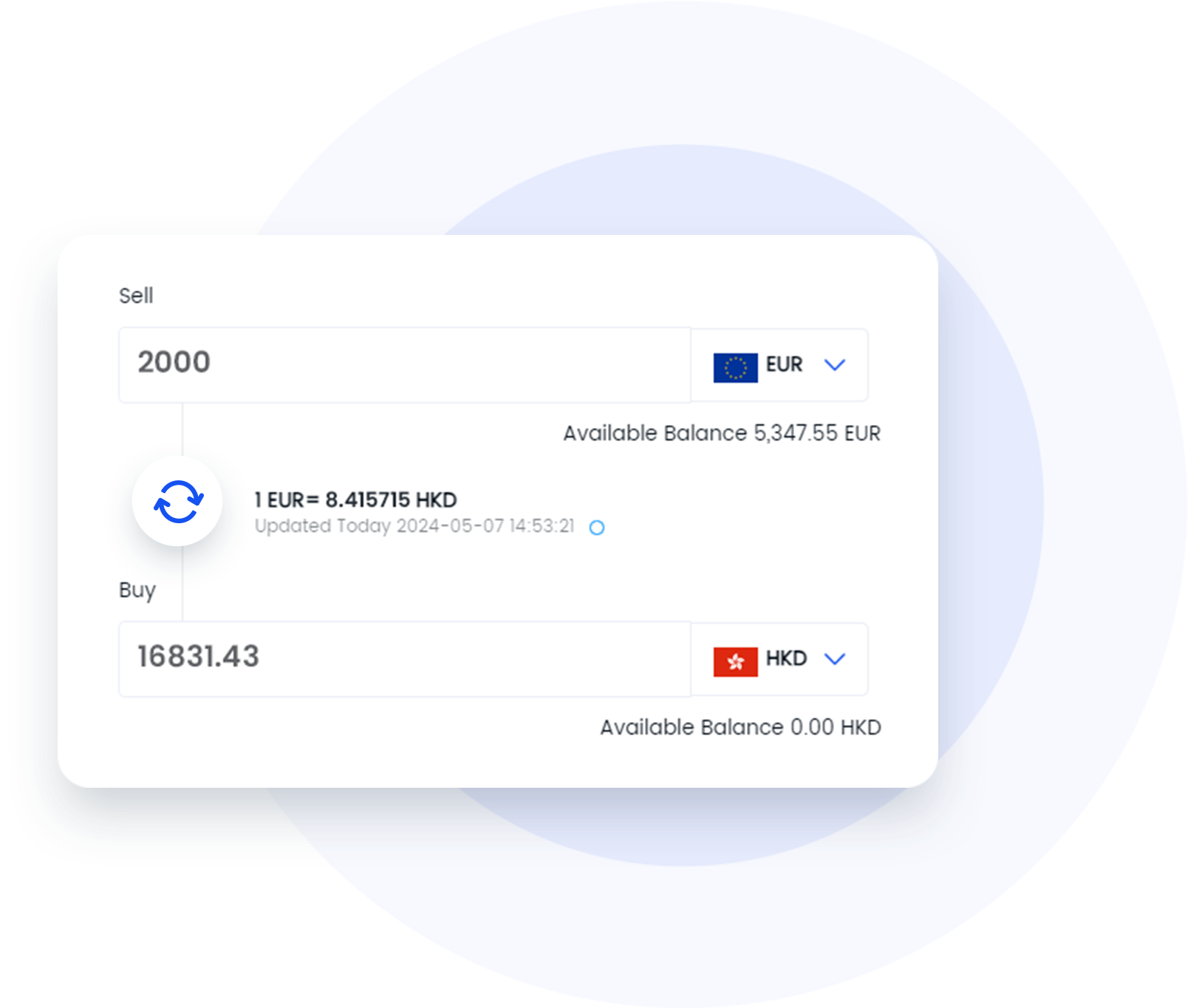

Competitive Rates

Access our services at competitive rates, ensuring you get the best value for your currency conversions.

0 Hidden Fees

Convert from major currencies in full with no hidden fees or deductions.

Operate 24/7

Receive FX quotes and conduct conversions seamlessly, even during weekends and holidays, ensuring uninterrupted access to financial services.

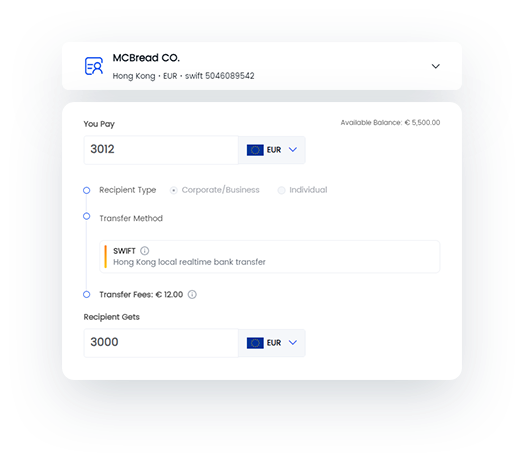

Versatile Multi-Method Payouts

Send local and international payouts utilizing various methods, including wire transfer(swift), FPS, ACT, RTGS.

Mitigate Cross-Border Compliance Risks

Secure money transmitter licenses across multiple countries to ensure adherence to regulatory standards and uphold the safety of payment operations.

Operate 24/7

Execute payments seamlessly, ensuring uninterrupted service even during weekends and holidays.

Compatible with Visa and Mastercard Schemes

MoneyCollect supports both Visa and Mastercard to ensure extensive acceptance, catering to your specific operating model.

Implement Blocks and Limits

Enhance control and mitigate risk by programmatically setting spending limits at both the program and card levels.

Use-Case Neutral

MC card programs are designed to serve various needs, including spend management, travel, and other applications, offering flexibility across different use cases.